Legal and Government News – What’s Happening Right Now

Welcome to your quick stop for the most important legal and government updates in India. We keep it short, clear, and useful so you can stay on top of changes that affect your life and work.

ITR Filing Deadline 2025 – What You Need to Know

The Central Board of Direct Taxes (CBDT) has moved the deadline for filing income tax returns (ITR) for FY 2024-25 to September 15, 2025 for non‑audit cases. If you’re filing an audit case, you still have until October 31, and transfer‑pricing cases get a November 30 cut‑off.

Missed the original date? No worries – you can file a belated or revised return up to December 31. Just remember there’s a late‑fee under Section 234F and interest under Section 234A, so the sooner you file, the less you’ll pay.

Why the change? The CBDT said major form revisions and portal readiness issues pushed the deadline back. In practice, that means you get a little more breathing room, but the tax season is still tight. Keep your documents organized, double‑check PAN details, and use the official portal to avoid mistakes.

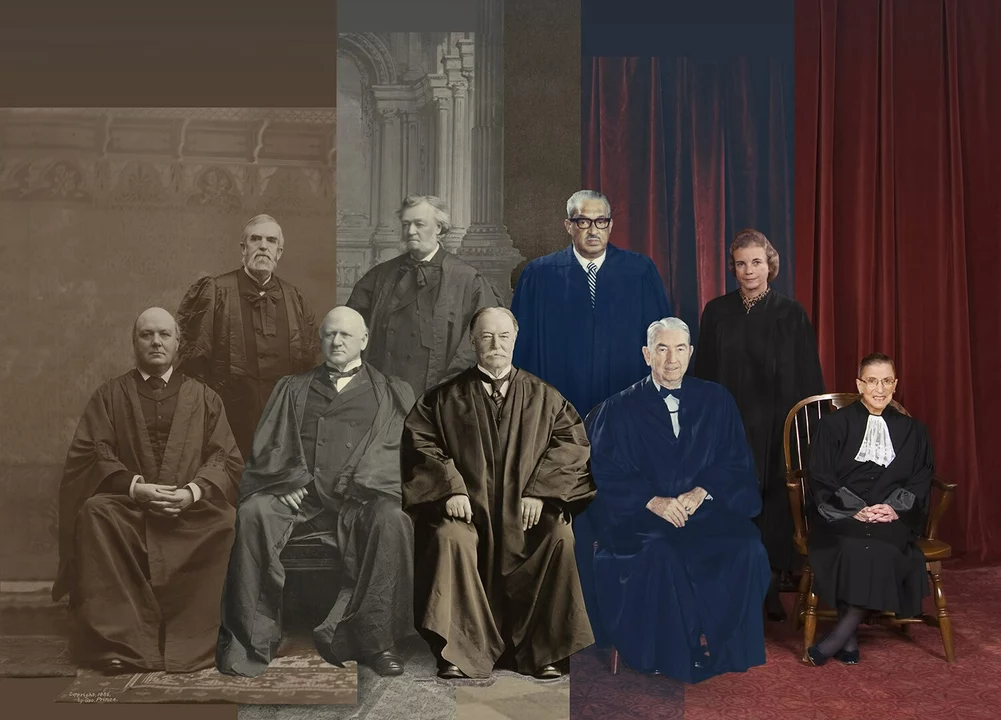

Supreme Court’s Take on Government Role

Recent Supreme Court commentary reminded the government that its main job is to protect citizens’ fundamental rights and keep power in balance. The Court stressed that policies should be transparent, accountable, and aimed at the public good.

In plain terms, the Court is saying the government can’t play favorites or ignore the law. Any new law or decision must pass the test of fairness and serve the people. This viewpoint reinforces the idea that democracy works best when the government acts as an unbiased mediator.

For everyday citizens, this means you have a legal backstop if you feel a government action oversteps its authority. Knowing the Court’s stance helps you understand where the line is drawn and when to seek legal recourse.

Both the tax deadline shift and the Supreme Court’s remarks highlight how legal changes directly impact daily life. Stay alert, keep records up to date, and don’t hesitate to ask a tax professional or legal advisor if something feels unclear.

That’s the snapshot for now. Check back regularly for fresh updates, practical tips, and simple explanations that help you navigate the legal landscape with confidence.

CBDT has extended the ITR due date for FY 2024-25 (AY 2025-26) to September 15, 2025 for non-audit cases. Audit cases are due October 31 and transfer pricing cases November 30. Belated and revised returns can be filed until December 31, with late fees under Section 234F and interest under Section 234A. The move follows major ITR form changes and portal readiness concerns raised by tax professionals.

In earlier rulings, the Supreme Court emphasized the importance of government's role in upholding the fundamental rights of citizens and ensuring a fair balance of power. The Court also highlighted that the government should act as an unbiased mediator and create laws that are in the best interest of the public. Additionally, the Supreme Court stressed the necessity for transparency and accountability in government actions to maintain the integrity of the democratic system. Furthermore, the Court has reiterated the importance of adhering to constitutional principles and safeguarding the liberties of citizens. In essence, the Supreme Court has consistently reminded the government of its responsibilities and its obligation to serve the people fairly and justly.

Government & Politics

Government & Politics